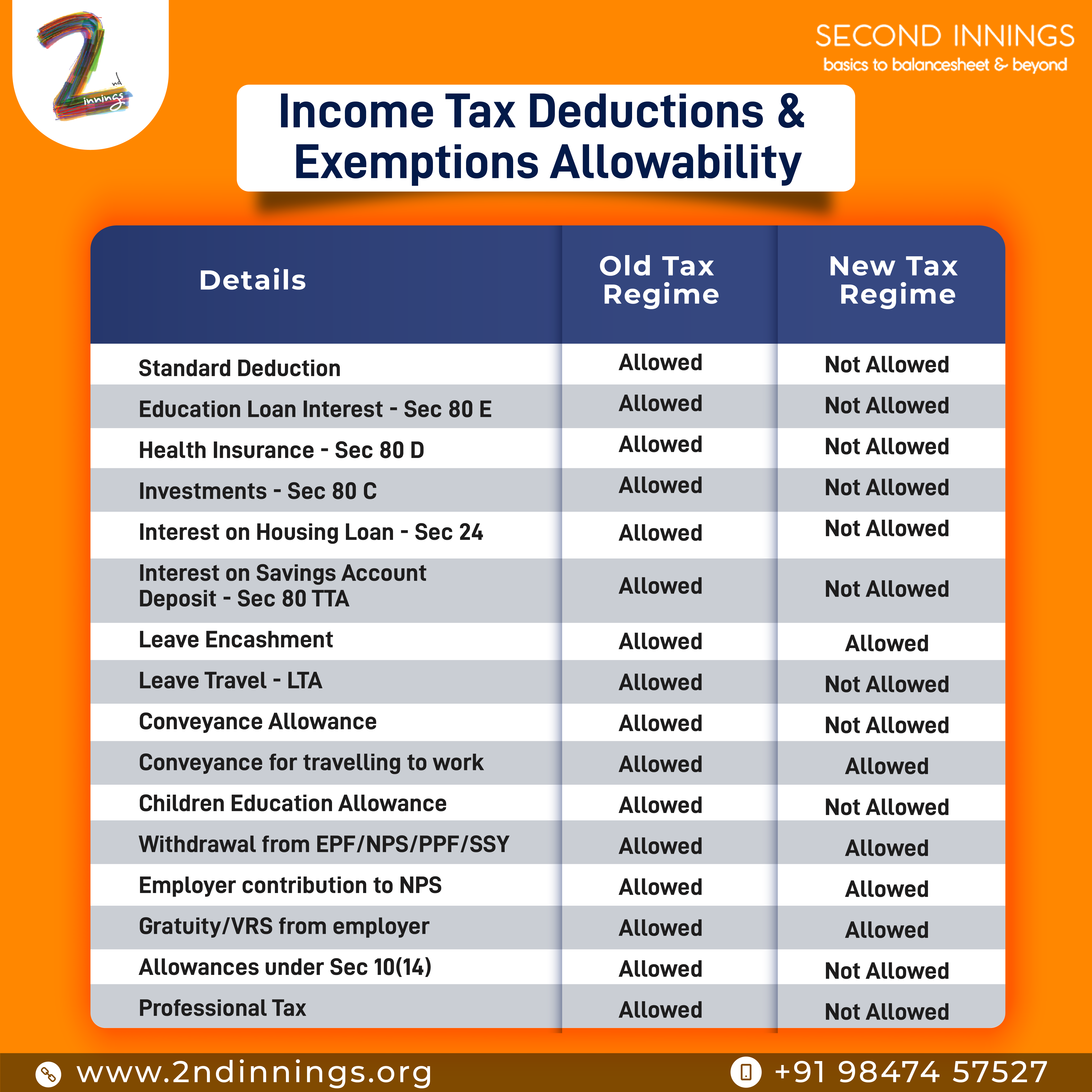

Are you an income tax payer? Are you ready to file your return? Then note that from FY 2020-21 you have two option to choose, 1. Old Tax Regime and 2. New Tax Regime. The new tax regime offers reduced rates but to avail that you need to forgo many of the deductions and exemptions. There is no way to know which regime suits one the most unless one does the computation under both the regimes and find out for themselves.

Another important aspect is that Salaried Person/Pensioners can opt in and opt out of new regime every year based on your income and exemptions and deductions, but those who have income from business or profession can do so only once. Once they opt out the person shall never opt in for the new tax regime again till he/she ceases to generate income from business or profession.

Those except Salaried Person/Pensioner has to file form 10IE before filing income tax return opting the new tax regime.

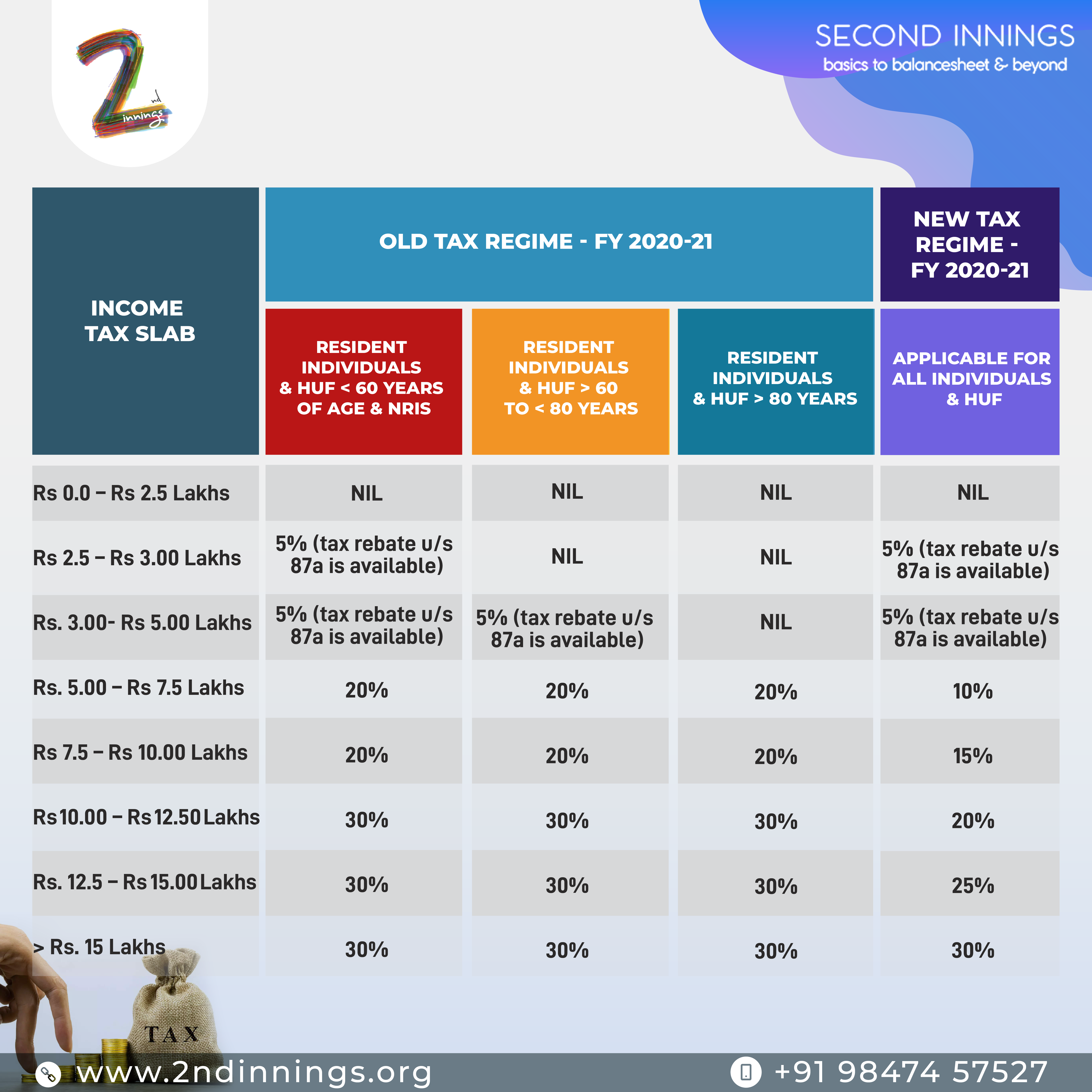

Given below table compares the Old Tax Regime & New Tax Regime which would help you to compute and decide which option to chose from while filing FY 2020-21 Return: